- Finance

How freelancers can maximize their retirement savings

This is a post from a member of the Freelancers Union community. If you’re interested in sharing your expertise, your story, or some advice you think will help a fellow freelancer out, feel free to send your blog post to us here.

It’s December already, which means the time remaining for all of those things you’ve been meaning to get done by the end of the year is rapidly dwindling.

If you haven’t made a contribution yet to your retirement savings in 2018, one of those end-of-the-year tasks should be setting aside part of this year’s income for yourself – that is, the future version of yourself. Whether or not you already have any retirement savings, you can improve your future financial security, while potentially saving some money on taxes today, by opening or contributing to a retirement account.

The most common questions freelancers ask me about saving for retirement are “how much should I save?” and “where should I put it?”. That’s because unlike traditional employees who have a plan set up by their employers to automatically deduct a portion of their salary, freelancers are completely on their own in making this decision.

I spend a lot of time with my clients on the question of how much to save, but truthfully the answer is almost always “as much as you can”. Even if you don’t plan to ever fully retire, having that cushion will make it easier to keep doing what matters to you. Would you rather wake up on some distant morning realizing that you have more than enough money to do what you want for the rest of your life? Or else find that out you want to make a change but can’t afford to depart from the status quo? The difference between those two scenarios happens in the decisions you make today.

The question of where to put those savings is a little more technical, but it’s important to understand your options if you want to maximize your retirement savings. The rest of this post is about the strategy I use with my clients to decide how to start saving for retirement.

I’ll start by saying that, as with anything that affects your taxes, it helps to talk to an expert. A tax professional who knows your situation will be able to help guide you to the type of account that’s best for you.

The level-up strategy

The biggest factor in deciding between different types of retirement accounts should be the amount of money you plan to contribute. The IRS makes it possible to defer taxes on a fairly large chunk of your income by saving it into several types of retirement accounts. Different types of accounts have different limits on the contributions you can make. It’s important to know before you open an account how much you can contribute to it each year and how that fits with your saving plan.

I often advocate a strategy for my freelance clients that allows them to maximize their savings potential by viewing the different types of retirement accounts as levels. As in the video game kind. You start at Level 1 when you’re early on in your career and can only afford to save a little; you reach Level 2 when you’ve mastered your early savings and can afford to save a little more; and you make it to Level 3 when you’re ready to put away some really serious savings. This simple approach makes it easy to decide what retirement account you should contribute to this year.

Level 1: the plucky IRA

If the great Nintendo game Punch-Out!! was about saving for retirement (and don’t we all wish it was), contributing to an IRA would be Glass Joe: easily knocked out with little more than a push of a button. Anyone can open an IRA, and while there are income-based limits to how much you can deduct, just about everybody can fund an IRA up to its limit of $5,500 in 2018 (this is increased to $6,500 if you’re age 50 or older, and both of these numbers will increase by $500 in 2019).

There are two types of IRAs: traditional and Roth. The traditional IRA allows you to take a tax deduction for your contribution in the year that you make it, while the money that you take out of it when you retire is taxable income. Roth IRAs flip that around: you can’t take a tax deduction when you contribute to it, but your savings are tax-free when you withdraw them after retirement. Choosing between the two is a longer discussion than this post allows, but in general, if your income is low and you’re in a low tax bracket, a Roth is a better idea; if your income and tax rate is higher, you may want to try a traditional.

If you can afford to save a few thousand dollars or less each year, an IRA is the simplest plan to open and administer. For freelancers with moderate incomes and no other retirement savings, the contribution rules are straightforward and there are no reporting rules aside from noting the contribution on your personal tax return. What’s more, you have until the tax filing deadline to open and contribute to your IRA, meaning that you can make a 2018 contribution any time up to April 15, 2019.

Level 2: the stepping-stone SEP

Ready to save more than the maximum IRA contribution? Congratulations, you’ve made it to Level 2!

As a freelancer you may not think you work for anyone, but in the eyes of the IRS you do have an employer: you. A SEP (short for simplified employee pension) is a type of retirement plan popular with small businesses. It works like this: the employer (that’s you!) contributes each year to an IRA for each of its employees (that’s also you!). From the IRS’s standpoint, when you make a normal IRA contribution you do so as an individual, whereas when you make a SEP contribution you do so as a business owner.

So what’s the difference? For one thing, you can contribute to a SEP in addition to a normal IRA, making the SEP a natural building block for freelancers who want to increase their savings. For another, the contribution limit is much higher than a normal IRA: up to $55,000 in 2018 (increasing to $56,000 in 2019).

With the higher contribution limit comes a caveat: sole proprietors (as most freelancers classify themselves for tax purposes) can contribute only up to 20% of their net self-employment income, so contributing up to the maximum requires earning close to $300,000 annually. There is also some complexity in determining your contribution limit – the calculation of “net self-employment income” involves accounting for half of your self-employment tax as well as the SEP contribution that you haven’t even made yet – so it’s best to have a tax expert help you find out how much you can contribute to a SEP.

Because the SEP contribution limit depends on your income, it can be hard for freelancers with a variable income to plan their contribution each year. I usually recommend setting aside a percentage of each paycheck – up to 20% if you want to go the max – in a bank account separate from your other funds. Like a regular IRA you have until the tax filing deadline to open and contribute to a SEP, so you can calculate your net income and your contribution limit after the end of the year – and because you’ve already set aside the funds, you don’t have to worry about having the cash available for your contribution!

Level 3: the heavyweight solo 401(k)

In Level 2 we saw how combining a regular IRA contribution with an “employer”-funded SEP contribution can help freelancers step up their retirement savings. But if you want to supercharge your savings, there’s one more way to do it: the solo 401(k) plan, reigning like Bowser over the kingdom of self-employed retirement plans.

Unlike a SEP, which is essentially an IRA that is funded by the employer, a solo (or individual) 401(k) is its own special type of account funded by both employer and employee contributions. Again, for a freelancer those are the same person, but the two contribution types have different rules that, when you combine them, can take your retirement savings to a new level.

The employer contribution rules for solo 401(k)s are similar to SEPs: you’re allowed to contribute up to 20% of your net self-employment income. (Again, it’s recommended to have an expert help you calculate this) But as an employee, you can contribute 100% of your income up to $18,500, or $24,500 if you’re 50 or older (and those limits increase to $19,000 and $25,000 in 2019).

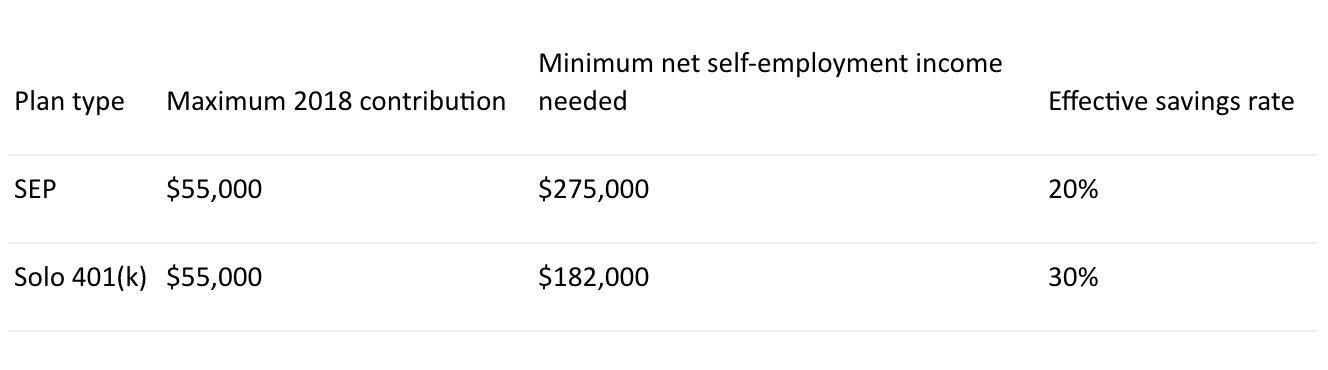

The total contribution limit for combined employer and employee contributions with a solo 401(k) is the same as the SEP: $55,000 for 2018 and $56,000 for 2019. But because the SEP is only employer-funded while the solo 401(k) combines both employer and employee contributions, you can fully fund a solo 401(k) with far less income, making for a much higher effective savings rate:

Even without making the maximum contribution, freelancers with lower incomes who are serious about saving can contribute more to a solo 401(k) than any other type of retirement plan:

If you want to open a solo 401(k), know that you need to set up your plan by the end of its first year. Like a SEP you can wait until after year-end to calculate your contribution, but if your solo 401(k) plan isn’t established by December 31st, 2018, you won’t be able to make a 2018 contribution. There is also a yearly filing requirement – IRS form 5500 – for plans with more than $250,000 in assets, and if you ever hire employees (a rarity for freelancers, but not unheard of) your plan will need to undergo testing to make sure the plan’s benefits are evenly distributed.

Because of the slightly more onerous rules for solo 401(k)s, they’re best for freelancers with moderate to high incomes who are serious about putting away significant money toward their retirement. If you’ve reached this level, you know you’ve mastered the game.

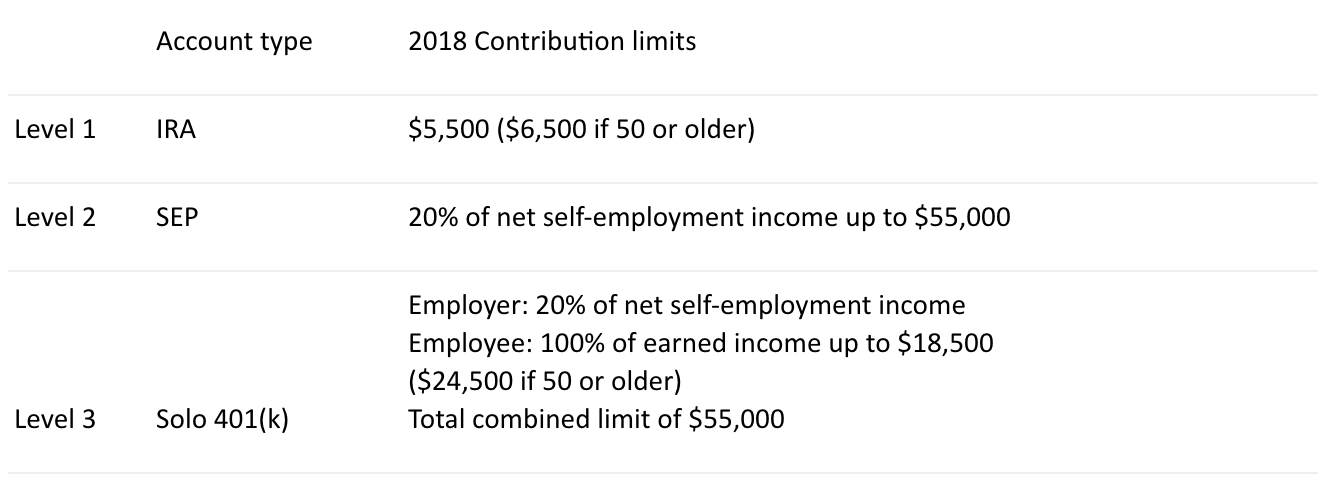

Here are the basics of each type of retirement account for freelancers at a glance:

The best part about the level-up strategy is that the levels can be layered on top of each other. Early in your career when you can only afford to save a little, opening an IRA is a great way to get started. Later on when you’re able to save more, you can add a SEP or, if you want to maximize your savings, a solo 401(k). (In case you’re wondering, you technically can contribute to both a SEP and a solo 401(k) in the same year, but the combined contributions can’t exceed $55,000 so you’re usually better off sticking with one or the other) You may still be able to contribute to your IRA while contributing to a SEP or 401(k), but you’ll need to note the limitations for people who are covered by retirement plans.

One final thing to keep in mind is that, as important as it is to have retirement savings, freelancers also need a source of accessible funds for the inevitable slow periods that come with being self-employed. All the retirement plans described above have a 10% penalty tax on early withdrawals before age 59 1/2, so they shouldn’t be considered a source for emergency liquidity unless there is truly no other option. If you don’t have accessible cash – the amount depends on the individual but for my clients I usually I target 6 months to 1 year – saved in a bank account or in low-risk taxable investments, make that a priority before trying to maximize your retirement savings.

Ben Henry-Moreland is a financial planner who specializes in helping freelancers and business owners reach their financial goals. In his early career he was a professional opera singer. You can find out more about Freelance Financial Planning at freelancefp.com or read more of Ben's blog posts at benhenrymoreland.com.