- Finance

A new PPP update could increase your loan forgiveness to 100%

On June 7, the Paycheck Protection Program Flexibility Act was passed into law, extending the covered period in which borrowers can use Paycheck Protection Program (PPP) loan funds from eight weeks to 24 weeks. The extension applies even if you received a PPP disbursement prior to the enactment of this new rule, and could be especially helpful to those without business overhead — aka most freelancers.

Keep in mind that if you elect to use the 24-week covered period, the amount that can be forgiven cannot exceed 2.5 months’ worth of 2019 compensation for any self-employed individual, and the amount that can be forgiven is capped at $20,833 per individual.

If you did receive a PPP loan, you are (hopefully) aware that, originally, the Small Business Administration had permitted borrowers to use the cash to cover eight weeks of their income and some expenses. This new rule extends the “covered period” for PPP loan forgiveness from eight weeks after receipt of the funds to the earlier of 24 weeks after loan receipt or December 31, 2020.

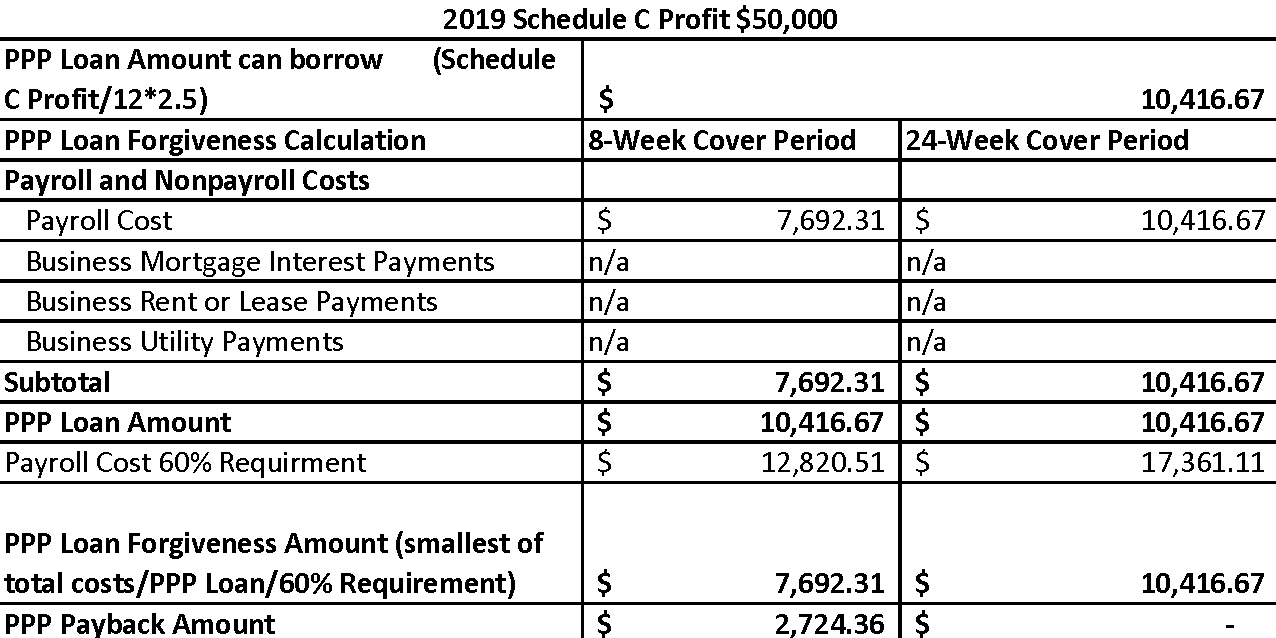

Now that the covered period for PPP has been extended, it is important to understand how this may impact you as a freelancer. Here is an example of the potential difference in PPP loan forgiveness using the eight-week window vs. the 24-week window, based on an individual reporting $50,000 of self-employment income on their 2019 tax return, with no overhead expenses:

As you can see, using the 24-week covered period allows you to maximize the amount of PPP loan forgiveness available to you, which is an underlying intention of the Paycheck Protection Program Flexibility Act.

As a reminder for freelancers, the eligible expenses that can be included in the payroll calculation include any compensation or income that is a wage, commission, income, net earnings from self-employment, or similar compensation, up to an annual cap of $100,000. Expenses for a free-standing, separate office or payroll cost for staff are also included.

Per the Federal Register in April 2020, there are also some important exclusions to the allowable PPP loan expenses, including home office deductions, your own health insurance costs, and retirement contributions.

As of June 30, the deadline to apply for a PPP loan was extended to August 8 by the U.S. Treasury, or until funding for the program runs out. Individual banks may terminate lending earlier - if your bank will not process your loan application, a number of online lenders may accept applications closer to the deadline.

Given the fluid nature of the PPP program and the ambiguity that still exists around the process for applying for PPP loan forgiveness, it is essential that freelancers who have participated in the program continue to monitor these additional changes and keep track of their PPP-related expenses in order to maximize loan forgiveness and avoid unwelcome and unexpected repayment obligations next tax season.

Jonathan Medows is a New York City-based CPA who specializes in taxes and business issues for freelancers and self-employed individuals across the country. He provides tax, accounting and business articles for freelancers on his website, http://www.cpaforfreelancers.com — which also features a blog and a comprehensive freelance tax guide. Please note: Due to the high volume of inquiries in regard to COVID-19, Jonathan is not able to respond to individual requests for information at this time.