- Finance

In the red? Watch out for these new tax changes

The new tax laws ushered in by the Tax Cuts and Jobs Act (TCJA), otherwise known as tax reform, will have a significant impact on the reporting and tax obligations related to the net operating loss (NOLs) for businesses that are organized as corporations. If your freelance business is structured as a corporation, and you have NOL (see the definition below), you’ll want to take note.

What is an NOL, and how do you know if you have one?

A net operating loss, or NOL, is realized when a loss taken by a company in a certain period (usually a tax year) makes its allowable tax deductions greater than its taxable income. In this situation, the NOL has traditionally helped companies recover past tax payments with the carryforward rule in place. However, the treatment of NOL for corporations is changing starting this tax year, due to the effect of the following new provisions:

The income limitation for NOL is reduced

Starting this year, if you own a corporation, you can establish an NOL for a maximum of 80 percent of your taxable income.

This is in contrast to previous years, when you could offset all of your taxable income with a NOL. If your total NOL is less than 80 percent of your taxable income, then you would only be able to claim the lesser amount.

Carryforward and carryback allowances for NOL are changed

Under the old tax rules, corporations could claim any NOL amounts back two years to lower their tax obligations. Not any longer (the exception being for non-life insurance companies and farming businesses).

As far as carryforwards of NOL (i.e. excess net operating losses above the 80 percent of your taxable income) are concerned, these can be carried forward indefinitely until they are exhausted. The exception to this is for non-life insurance companies, which keep the previous 20-year carryforward rule.

Here is an example of how these new tax rules could come into play for a freelance business set up as a corporation:

A practical example: ABC Corporation's Tax Liability After the NOL Carryover

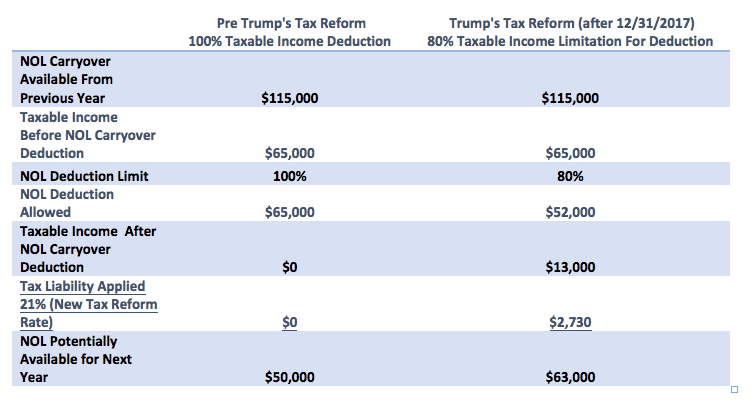

The following chart illustrates how the changes in NOL income limitations and carryover rules would affect a corporation that had $115,000 in NOL and taxable income of $65,000.

Under the previous tax rules, the NOL would have been 100 percent deductible. Therefore, the taxable income would be zero, and there would be a $50,000 NOL carryforward to be used to offset taxes up to 20 years later.

With the new tax rules, the NOL is only 80 percent deductible. Therefore the taxable income is $13,000. At the 21 percent tax liability rate, the company would now owe $2,730 in tax and they would have a $50,000 NOL carryforward to be used in other tax years, indefinitely.

The bottom line

As you can see, these changes may have a significant impact on your business if you have traditionally had net operating losses, or if you are a start-up business with considerable expenses and proportionally less income. If this is the case for you, you should be prepared that your tax bill may increase this year.

You may also want to consult with a tax professional to look at additional alternatives for reducing your taxable income this year and for years when you anticipate having fewer NOL deductions.

Jonathan Medows is a New York City based CPA who specializes in taxes and business issues for freelancers and self-employed individuals across the country. He offers a free consultation to members of Freelancer’s Union and a monthly email newsletter covering tax, accounting and business issues to freelancers on his website, www.cpaforfreelancers.com which also features a new blog, how-to articles, and a comprehensive freelance tax guide.

Jonathan is happy to provide an initial consultation to freelancers. To qualify for a free consultation you must be a member of the Freelancers Union and mention this article upon contacting him. Please note that this offer is not available Jan. 1 through April 18 and covers a general conversation about tax responsibilities of a freelancer and potential deductions. These meetings do not include review of self-prepared documents, review of self-prepared tax returns, or the review of the work of other preparers. The free meeting does not include the preparation or review of quantitative calculations of any sort. He is happy to provide such services but would need to charge an hourly rate for his time.