- Finance

Sick of getting dinged by the IRS? It’s time to use a freelance accounting software

Ask any freelance worker what the toughest aspect of being independent is and they will likely tell you it’s running the day-to-day operations of their business: invoicing, managing time and projects, and the dreaded quarterly tax prep that comes with being your own boss.

It’s not easy, and as it turns out, a large share of freelancers are consistently making mistakes on their tax returns that are causing them to incur steep penalties. The Wall Street Journal reports that between 2010 and 2015, the number of Americans underreporting their quarterly tax estimates rose by 40 percent.

While the reasons for this are many, there are a few likely culprits.

You’re in denial

Many people who decide to go independent are shocked by the portion of their paychecks they must slot away for things like self-employment tax, regular income taxes and insurance. That’s why it’s critically important to factor these things (as well as additional business expenses) into your rates. A good rule of thumb is to determine the estimated yearly salary for the work you’ll be doing (tools like Comparably can help with this) and multiply by 1.4 to get your freelance-equivalent salary. From there, you can work backwards to identify a day rate or hourly rate based on how many days (or hours) you plan to work per year.

Estimating your quarterly tax obligations is difficult because it involves properly accounting for all of your taxable income during that time, minus the various business expenses you racked up that are eligible for a write-off. Along with these, there are several rules and best practices to navigate that might prove confusing for a new freelancer. While it’s advisable for newly-minted independents to partner with an accountant to assist them at the beginning, tools like this bot-based quarterly tax calculator can provide a ballpark estimate.

You’re manually tracking your finances

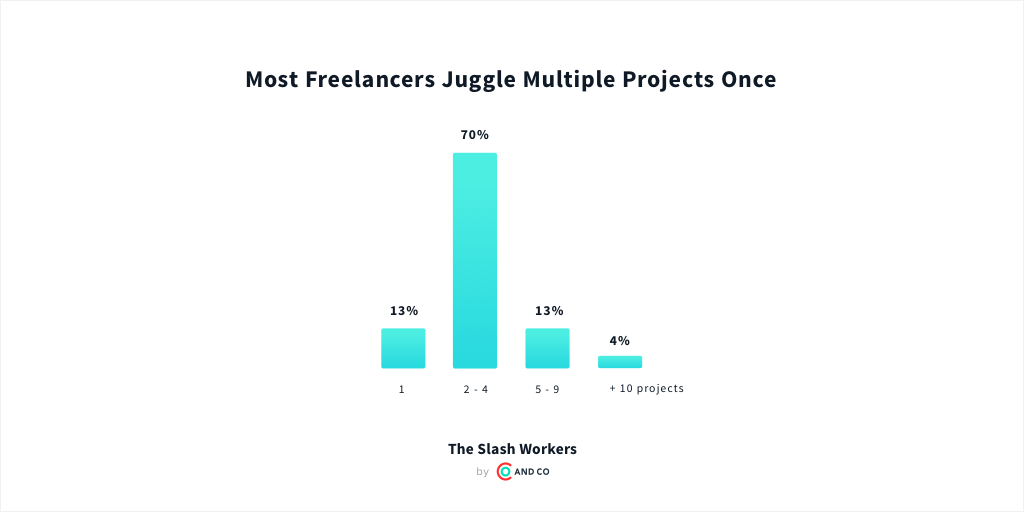

Simple accounting errors are another likely factor. Per AND CO’s Slash Workers study, most independent workers are juggling several clients and projects at a given time. That means that during a given week, most freelancers are managing partnerships on staggered timelines: contracts coming in, invoices going out, payments coming in, etc. It can be a lot to keep track of—especially when you factor in all of the expenses you’ll be racking up along the way.

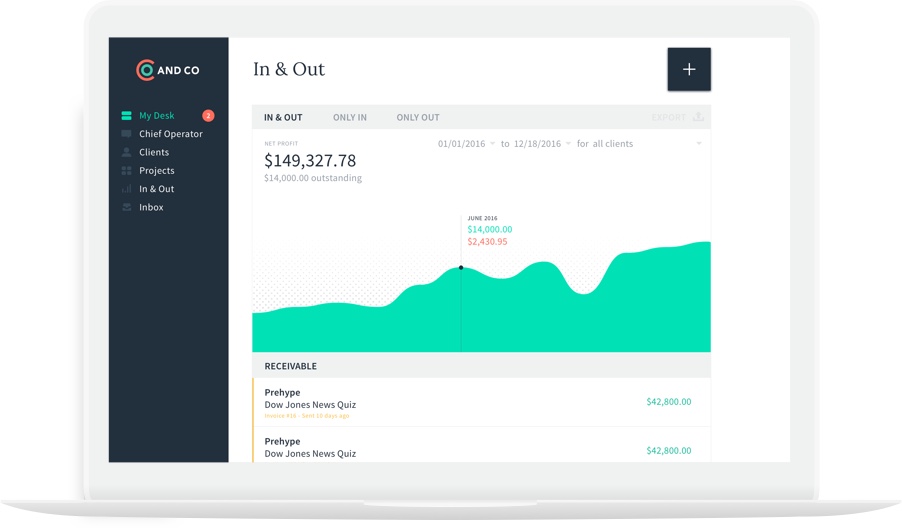

As your freelance business grows and evolves over time, you might find it necessary to invest in an accounting and reporting software to help keep track of the money coming into and going out of your business. AND CO’s accounting software, for example, tracks your invoices as they are paid out and automates your expense reporting by syncing with your credit cards.

Automating your finances not only saves time, but it also promotes accuracy when it comes to the revenue you’re reporting to the IRS on a quarterly basis. Instead of reverting to spreadsheet tabs, why not let a technology partner do the math for you? Using a freelance accounting software will make it easy to isolate what’s coming in and going out of your business during a specific period of time (e.g. the past quarter).

You’re not thinking of yourself like a business

As the freelance movement picks up steam, independents are beginning to see themselves not as contractors, jumping from gig to gig at the mercy of their employers, but rather as entrepreneurs who are at the helm of their own businesses. This shift in mindset has led to freelancers approaching the business side of their careers with more diligence.

Making errors on the financial side of your business is to be expected from time to time—especially if you’re just getting your feet wet—but being sloppy when it comes to accounting is a surefire way to get into hot water with the IRS. Think back to your last full-time role: would it be OK if the controller were to “phone in” the accounting side of things?

As a business owner, the onus is on you to stay on top of these things. This might be a tough pill to swallow, since you’d much rather being doing what you love (AKA the billable work you left your F/T role to focus on), but fortunately there are ways to cut down on the time you spend managing the operations of your business. In this regard, technology is your best friend. Seek out tools that can automate and help you stay on top of important deadlines.

Let’s recap

Here are a few things you can start doing today to avoid annoying fees from the IRS:

- Use a quarterly tax estimator to understand your likely liability. Want to be safe? Slot a little extra aside than you think you need.

- Upgrade your accounting software. It doesn’t have to be daunting, and tools like AND CO make it ridiculously easy to track the ins and outs of your business.

- Change your mindset. As a freelancer, you are CEO, CFO and COO of your business. Take your taxes seriously and arm yourself with the knowledge and technology required to report accurately each quarter.

Katie Perry is editor at AND CO, an app that helps freelancers, solopreneurs and digital nomads manage their operations. For the latest and greatest freelance gigs each week, check out The Gig List by AND CO.

This is a sponsored post by our friends at AND CO, an invoicing app for freelancers. Check out our co-created Freelance Contract here.

With over 300 contributors and 2 million readers, the Freelancers Union Blog is the foremost publication dedicated to empowering the independent workforce. If you'd like to partner with us, please get in touch at partnerships@freelancersunion.org.

The contents of this article were not written by an accountant. Since tax obligations vary from freelancer to freelancer, it’s advisable to consult an accredited accountant or tax specialist for specific questions surrounding your own business.