- Finance

4 Easy ways to keep track of receipts

Keeping track of receipts for your small business is very important: it keeps you organized, keeps you on budget, and can be a big money-saver when you file deductions at tax time.

The IRS is not a big fan of estimating your expenses. If you are going to claim a deduction, you’re going to need:

- When: The date of the transaction

- Where: Where you bought the item

- What: What the item was

- Why: What purpose it served in your business

When, where, and what are generally found on a receipt, which is why the IRS loves when you keep them! But nothing is worse than a huge, bulging, disorganized folder full of a year’s worth of receipts.

Try these systems instead:

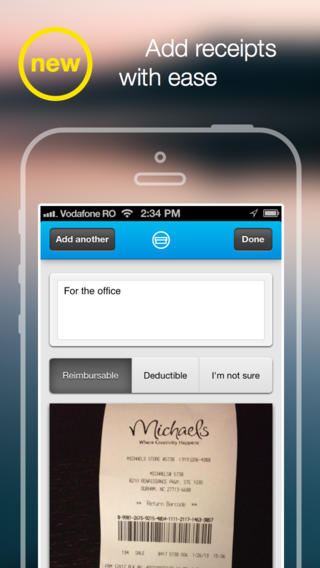

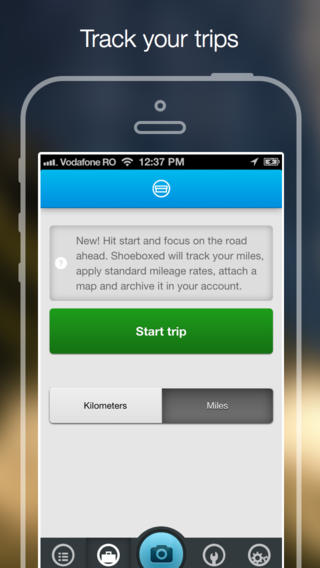

1. Shoeboxed

This is an iPhone, Android, and iPad app that also has a desktop feature. At its most basic level, it allows you to photograph and track receipts, record expenses and categorize them, and even track miles you travel for work.

If you want to pay a little more, they have this neat “Magic Envelope” system, which allows you to put all of your paper receipts and business cards in an envelope and ship it off to Shoeboxed headquarters; they then scan all of your paper documents, parse and process the information on the receipts for you, and categorize them into spreadsheets. It’s sort of like having a personal assistant and accountant, all with the ease (and price point) of sending your DVDs back to Netflix.

Cost: Basic is $9.95/month, $100/year

2. Mint.com

While this program isn’t made specifically for cataloguing receipts, you can input expenses individually to keep track of them or import expenses directly from your bank accounts.

If you have a separate bank account and credit/debit card for your business, this may be the easiest way to keep track of expenses. Just make sure that the information the bank records also includes the exact item (not just the vendor’s name) and that you remember or amend the purpose of that item.

The great thing about Mint.com is that your receipt tracking won’t operate separately from the other financial information you track (like savings and income from clients). They also can work together with TurboTax to make filing faster.

Cost: Free

3. Excel/Google Spreadsheets

If you like simple grids and avoid fancy apps, this is for you. Just keep in mind that even if you document your expenses in an Excel spreadsheet, you’ll still need to keep a backup of your paper receipts, unlike Shoeboxed and OneReceipt.

Try making a simple spreadsheet with these columns:

Date Category Vendor Cost Purpose

Here are some categories you should keep in mind that will make it easier for taxes:

- Travel

- Office rent and/or home office mortgage

- Office utilities

- Office supplies, including tech

- Meals with clients

- Marketing (website, business cards, etc.)

For a full list of things you can deduct, see this post.

Cost: Free

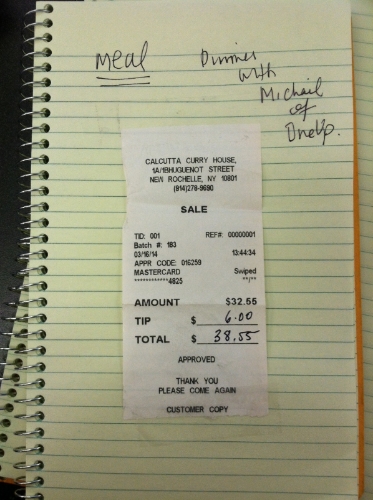

4. The paper method

For those of you who want to do it old school-style. Not nearly as automated or efficient come April 15, but it works for thousands of people!

You can do this in a number of ways, including:

- Buy a spiral notebook. Tape receipts into the notebook, one per page, and scribble any additional information onto the page.

- Copy your receipts with a copy machine so that you get a clean, unwrinkled 8.5x11” sheet, and then stick it in a filing cabinet with appropriate labels.

- If you don’t have many receipts, just take a basket, put it in your office, and throw receipts into it. While this is not a very elegant method, having one easily-accessible place where you put all your receipts can serve as a reminder to hang on to them in the first place. You will have to sort through them at the end of the year.

Cost: $2 for a notebook, miscellaneous expenses for copy paper and ink

Got any tips for keeping track of receipts? Share ‘em!