- Finance

How Switching to an S-corp Could Save You $5k or More

This post is provided by our partner, Opolis. Get employment tools normally reserved for traditional “employees” like legitimately premium health coverage, high-quality retirement plans, semi-monthly paystubs, annual W2s, tax compliance, and more with Opolis: https://opolis.co/freelancers-union/

What would you do with an extra $5000 or more? Join the income and payroll tax-saving adventure, entrepreneurs and independent contractors! Today, we are exploring small business tax optimization strategies in the United States to help you protect your earnings.

The key to your savings starts with the legal structure you choose for your small business. Thanks to a 2018 tax law change, many owners can now elect S-corporation status to save a ton of money on their taxes.

S-corps offer business owners amazing tax breaks and financial perks and are relatively easy to set up. But if you don't have one yet, don't panic! Opolis makes that part easy.

Before you dismiss this as another mundane tax topic, let's explore how you can keep more of what you earn–that’s fun, right? First things first…

What is an S-corporation?

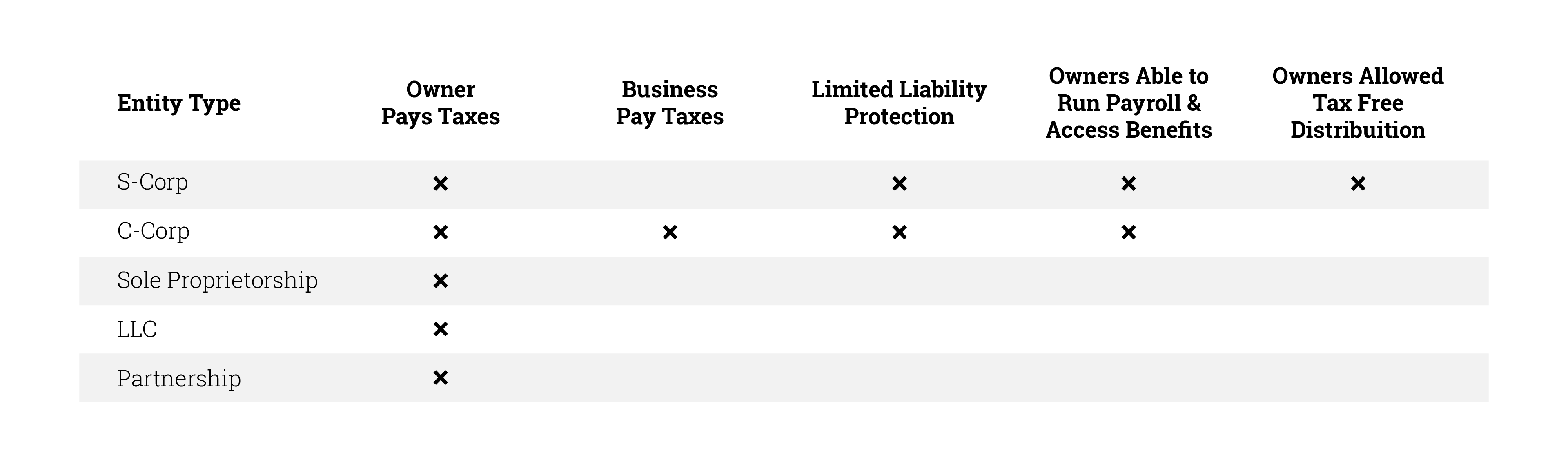

Simply put, an S-corporation (S-corp) is a unique tax election recognized by the IRS. It provides certain tax benefits and legal protections for its owners:

- As a proud owner of an S-corp, you wield a nifty perk known as limited liability protection. Translation? Your S-corp shields your personal assets in case someone sues your company.

- S-corps are businesses that don't pay taxes on their profits. Instead, the owners are responsible for paying taxes on the money they make." Unlike C-corporations (C-Corps) where both the company and its owners foot the tax bill, S-corps dodge the double-taxation trap. And for you as the owner, that's where some of the tax savings come in.

- As an S-corp owner, you must pay yourself a "reasonable salary" as an employee. Opolis suggests allocating 50-70% of your business profit to your salary.

Chat with a CPA to determine the right percentage for you. This ensures that your salary is fair and aligns with your work. This does mean you’re now dealing with employee payroll taxes, but more on that later (i.e.: we got you!).

Many entrepreneurs shy away from transitioning to an S-corp because of misconceptions about complexity and cost. Many believe that S-corps come with a lot of paperwork and expensive administrative fees. While they have more formal requirements than sole proprietorships, the financial benefits typically outweigh the extra tasks.

So, how do S corps deliver on their promise of tax efficiency? We hear you in the back:

"How will this actually save me time and money?" Let’s go.

Automate your Quarterly Tax Estimates via Payroll

First off, remember that “reasonable salary” you are paying yourself? You are the employee of your own gig, and when payday rolls around, Uncle Sam takes his cut directly from your paycheck. No more waiting until tax season to deal with that headache! Payroll deducts and remits these taxes semi-monthly.

When you're on the company payroll, your company splits the FICA (self-employment) payroll taxes. The FICA tax rate (15.3%) includes Social Security and Medicare as payroll taxes.

Your salary and the payroll taxes paid by your S-corp can be tax deductions for the company. This means that you can save money on taxes by deducting these expenses. A great way to reduce your tax liability and keep more of your hard-earned money. That means less stress come tax time and more money in your pocket throughout the year.

You can deduct qualified business income thanks to the Tax Cuts and Jobs Act. Make sure to keep accurate records of these expenses to take advantage of this tax benefit. So when tax season hits, your overall taxable profits are lower, and that means you pay less in taxes. Like magic, but with numbers.

Strategic Retirement Planning with an S-corp

For entrepreneurs keen on maximizing their retirement savings, electing S-corp status presents a strategic advantage. S-corporations allow owners to participate in retirement plans that may not be accessible to sole proprietorships or partnerships. This means that owners of S-corporations have more options for saving for retirement. This can be a pivotal benefit for those looking to secure their financial future while reducing current taxable income.

An S-corp can contribute to retirement plans, like a 401(k) or SEP-IRA, for its owner. These contributions are tax-deductible, lowering the overall taxable income of the business.

An S-corp owner can contribute $23,000 to a 401(k). The S-corp can also add profit-sharing up to the maximum limit, lowering the owner's tax bill significantly. This can be a strategic approach to helping solopreneurs to achieve their financial goals in the long run.

To sum it up:

- Your S-corp pays you directly (like the professional you are) via payroll each pay period.

- Taxes are deducted from your paycheck and sent to the government each pay cycle. This means you don't need to worry about a large tax bill at the end of the year. You also don't have to make large estimated quarterly tax payments.

- At tax time annually, your business claims your salary and benefit insurance premiums as deductible expenses, which will lower your taxable profits.

Now let's chat about how Uncle Sam taxes those sweet, sweet profits from your S-corp.

Escape the Self-Employment Tax Trap

The true magic of S-corps lies in their treatment of profits.

S-corp owners can avoid high self-employment taxes by only paying taxes on their salary. They do not have to pay taxes on any extra money they take out of the business. With an S-corp, you only pay payroll taxes on the salary you earn, not on any extra profits. However, sole proprietors or single-member LLCs face high taxes on their total income.

If your S-corp makes $100,000 in profits after expenses, you can pay yourself a salary of $70,000. You can then take the remaining $30,000 as dividends. This strategy can save you a ton in taxes compared to other entities.

S-corps are attractive to businesses with different income levels. Owners can change their draw based on how the company is doing and their personal financial situation.

So how does this shake out for your savings? Let's look at an example.

Breaking Down the Math

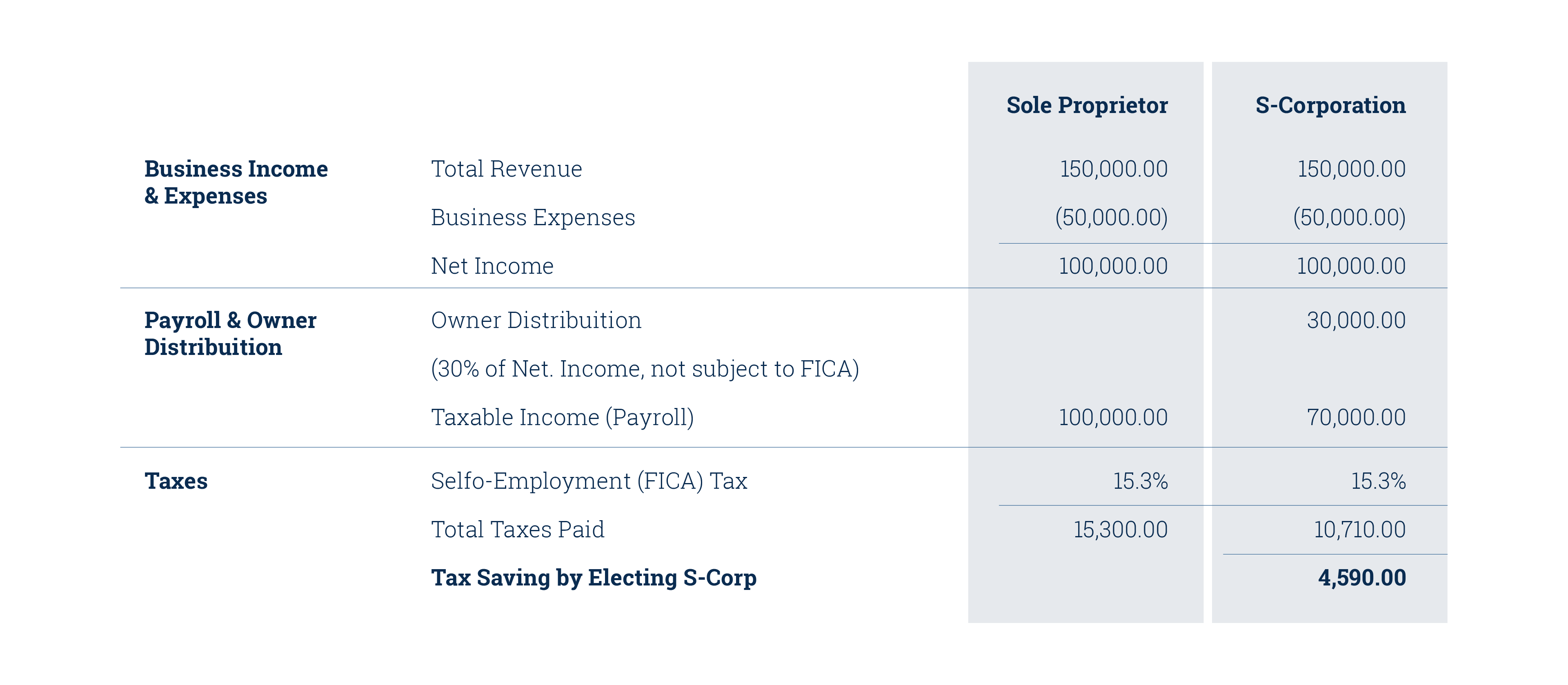

Meet Jane, a savvy consultant pulling in $150,000 in revenue for her business. She must choose between operating solo as a sole proprietor/LLC or joining the S-corp. Let’s break down her tax rates in both scenarios:

The Verdict

What are the tax savings between these two scenarios? $4,590 in additional money in Jane’s pocket because she elected S-corp!

The savings are staggering if Jane chooses to convert or set up an S-corp and distribute 30-50% of profits to herself instead. Their structure offers amazing tax savings for business owners.

So, what would you do with an extra $5000 of after-tax income?

Is an S-corp Right for Me?

For folks looking to tweak their tax game and lock in some serious financial stability, S-corps are an incredible choice. However, if your annual S-corp net income falls short of $80,000, diving into the S-corp realm might not be right for you, as 50-70% of $80k may not satisfy your State’s minimum salary requirements. To have your cake and eat it too, you need to be able to run a reasonable salary and distribute enough tax-sheltered profits to yourself via owner distributions.

Optimize Your Tax Game

Need help getting your S-corp started or converted from another business structure? Become a Member of the Opolis Employment Commons!

Our seasoned stewards are ready to guide you through setup and tax optimization. Opolis can help you maximize savings and minimize tax headaches.

Safeguard your hard-earned cash from the taxman's clutches. Let's turn your financial dreams into rock-solid reality. Start your savings now.

Convinced by now? Visit https://opolis.co/freelancers-union/ to get started today!