- Finance

8 ways to wise up on your retirement savings as a freelancer

Honest Dollar is passionate about making saving for retirement simple and flexible for freelancers. To help you save for retirement we offer Individual Retirement Accounts (IRAs). Below are some responses to FAQs – some you may know, some may surprise you.

Why should I open an IRA?

Most Freelancers do not have access to an employer sponsored account (such as a 401(k)), so Roth, Traditional and SEP IRAs are common and accessible ways for Freelancers to save for retirement.

What are the tax advantages of IRAs?

-

Roth IRA – Pay taxes on the money you put in now, don’t pay taxes on it when you take it out after age 59½

-

Traditional IRA & SEP IRA – Save on taxes on the money you put in now and pay taxes when you withdraw it

What is the maximum amount I can contribute?

The maximum amount you can contribute each year varies by the IRA option you choose:

- Roth IRA – Below age 50: $5,500 / Age 50+: $6,500 (for 2016 & 2017)

- Traditional IRA – Below age 50: $5,500 / Age 50+: $6,500 (for 2016 & 2017)

- SEP IRA – 25% of your self-employed income, up to $53,000 (for 2016) or $54,000 (for 2017)

Why an IRA and not a savings account?

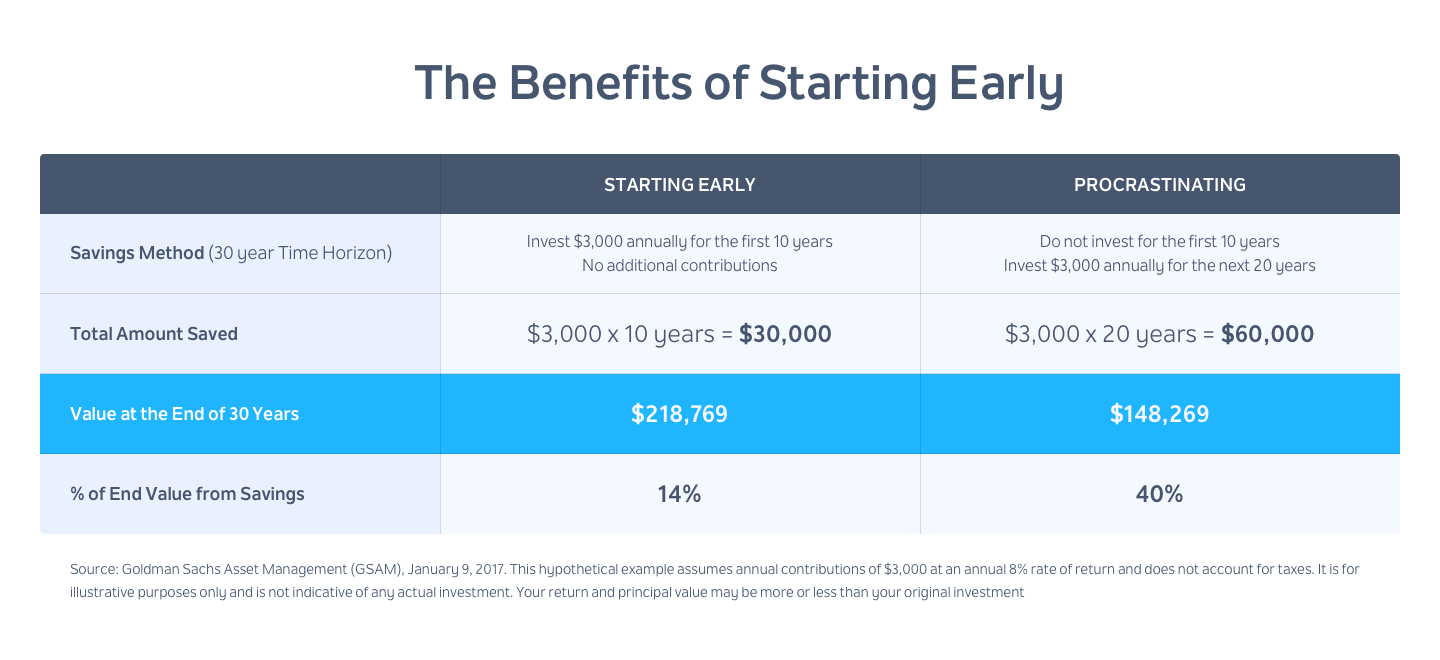

First, there are tax benefits as listed above. Additionally, investing in a retirement account like an IRA means that you can take advantage of compounded growth — that means that as the portfolio grows tax-free, the money gets re-invested in the markets. Because of this, starting early can have a big impact on your retirement balance when it comes time to retire:

Can I contribute whenever I want? Can I change my contribution amount as I'm paid for big/small jobs?

Yes! You are in control of how much you want to contribute each time to an IRA, as long as it does not result in you exceeding the maximum yearly contribution.

With Honest Dollar, you have the option to set up small recurring contributions if you’d like. Then, if you want to make a larger one-time contribution when you’re paid for a big job, you can do that very easily.

Can I take money out early?

- Roth IRA – Withdrawals of principal are allowed with no penalty or income tax. Withdrawals of gains on your investment prior to age 59½ are generally subjected to a 10% IRS penalty along with the applicable taxes

- Traditional IRA & SEP IRA – Any withdrawals prior to age 59½ will be generally subjected to a 10% IRS penalty along with the applicable taxes

What percentage of each paycheck should I put away?

Guidance on the percentage of earnings to save towards retirement ranges. It’s more important to get in the habit of saving what you can early, and then increase your savings target from there. If you’re looking for a reference point, a 2014 study from the Boston College Center for Retirement Research suggests a typical household save about 15% of earnings toward retirement.

How do I choose between a Roth, Traditional and SEP?

Choosing between a Roth, Traditional or SEP IRA breaks down to a number of personal factors such as your income level, or the contribution maximum, and tax treatment that make sense for you.

Some points to consider:

- Do you think you can contribute more than $5,500 this year? It might be worth looking into a SEP

- Do you want to pay taxes now, perhaps because you will be in a higher income tax bracket in the future? A Roth may be right for you

- Do you want to save on taxes on your contributions now, and pay taxes when you withdraw in retirement? You can do this in a Traditional or SEP

As a final tip, don’t let the name “Simplified Employee Pension (SEP)” trick you, Self-Employed individuals are eligible for a SEP

It's never too late to start: Join us on January 18, 2017 at 1 pm EST for a webcast on saving for retirement presented by Honest Dollar. To register for the webcast, please click here.

Sources: irs.gov

This information is subject to change and should not be considered legal or tax advice. Individuals may not qualify for the IRA choices offered and not every IRA is suitable to every person due to individual circumstances. Honest Dollar does not provide legal or tax advice and if you have questions regarding your personal circumstances, you should consult a tax or legal professional.

Goldman Sachs & Co. LLC (“GS&Co.”) does not provide accounting, tax or legal advice. Nothing communicated to you on this website should be considered tax advice. You should consult an independent tax professional regarding your personal circumstances. This material is provided solely on the basis that it is educational only and will not constitute investment advice. GS&Co. is not a fiduciary with respect to any person or plan by reason of providing the material or content herein.